KNOW YOUR WORLD. KNOW YOUR SELF.

UNPACK THE COMPLEXITY OF EVERYDAY LIFE

Search + Filter

TYPE

TOPIC

Featured

EDUCATION

DEMOCRACY

AI

WAR

YOUTH

IDENTITY

{{featureTitle}}

-

Opinion + Analysis

Society + Culture

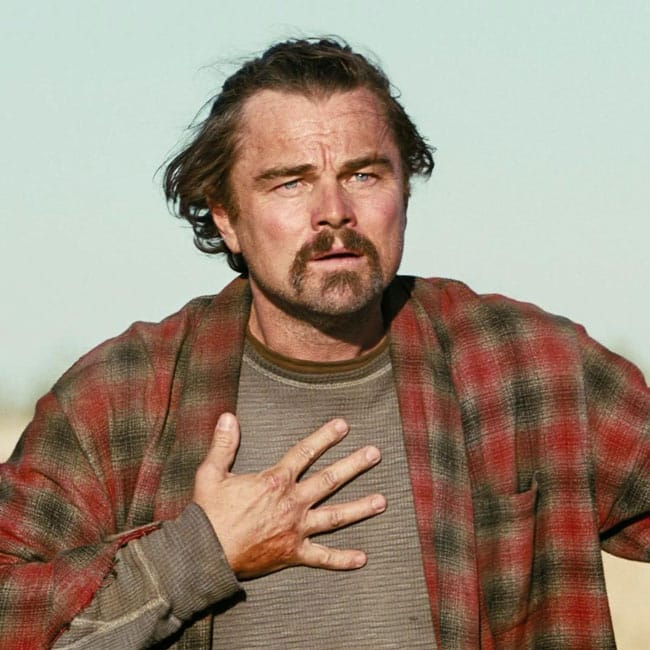

The personal vs the political: Resistance in One Battle After Another

2 MARCH 26

-

-

-

Opinion + Analysis

Politics + Human Rights

Our dollar is our voice: The ethics of boycotting

17 FEBRUARY 26

-

-

-

-

Opinion + Analysis

Relationships

Ask an ethicist: Should I tell my student's parents what they've been confiding in me?

28 JANUARY 26

-

Opinion + Analysis

Society + Culture

Does 'The Traitors' prove we're all secretly selfish, evil people?

21 JANUARY 26

-

Opinion + Analysis

Politics + Human Rights

Play the ball, not the person: After Bondi and the ethics of free speech

15 JANUARY 26

-

-

Opinion + Analysis

Politics + Human Rights

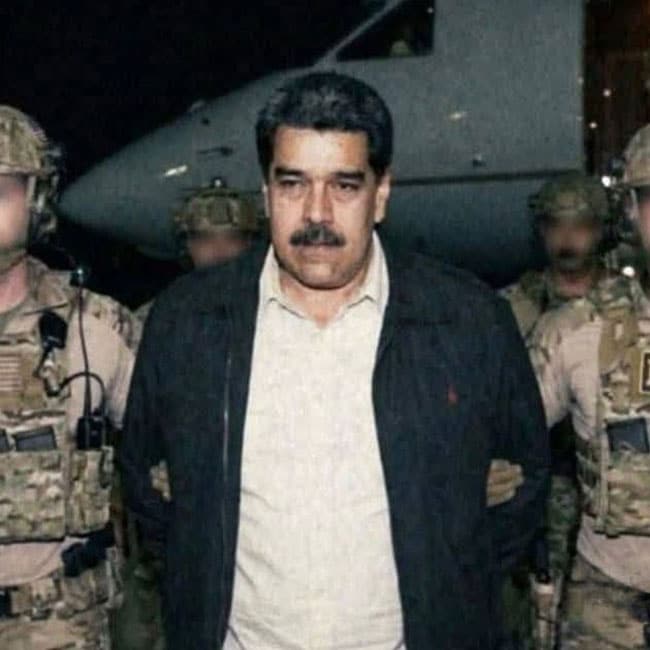

Unrealistic: The ethics of Trump’s foreign policy

12 JANUARY 26